New Portuguese SAF-T with Accounting data required in 2018

As from 1 January 2018, tax authorities will require an annual SAF-T including accounting data for corporate tax purposes. The new Portuguese SAF-T file must be submitted to the tax authorities upon request.

Portuguese SAF-T with Accounting data required in 2018

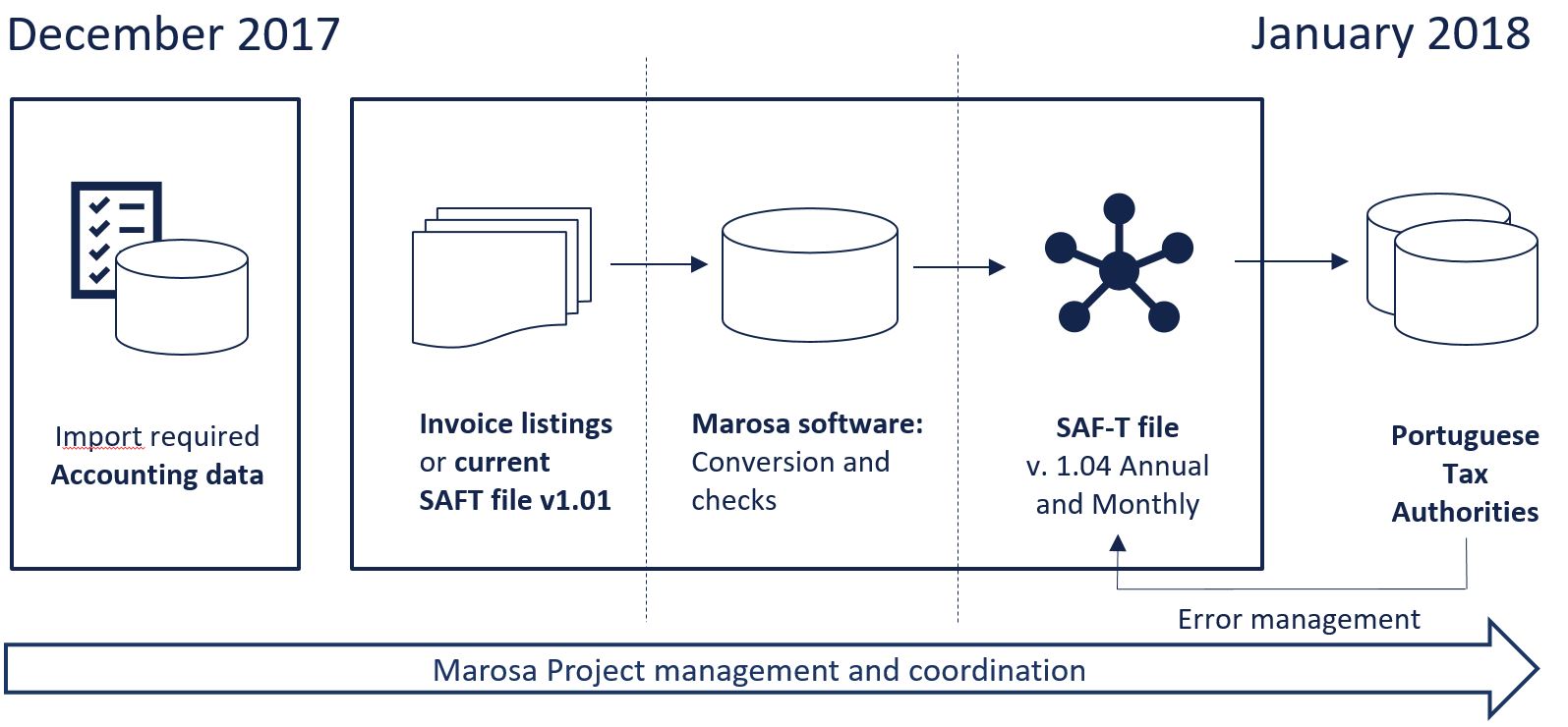

Marosa has a software solution certified by the Portuguese tax authorities to convert your ERP invoicing data into the SAF-T file required by the tax authorities. Contact us to receive more information.

The new data requirements include high-level information about the accounting plan of the company. The authorities refer to this information as Taxonomy, and in addition to master data and product list of all goods and services traded in Portugal, it includes the relevant account where each combination of product-counterparty would be booked.

Annual Accounting Portuguese SAF-T versus Monthly invoicing Portuguese SAF-T?

As from 2018, two separate files will be required for Portuguese SAF-T purposes. Your monthly SAF-T file including invoicing data and your annual SAF-T file with accounting information.

Monthly SAF-T files include transaction data about sales and purchases made in Portugal. In addition, this file also requires master data and a list of products to be included. These files are submitted on a monthly basis to the Portuguese tax authorities.

The Annual SAF-T must be produced yearly and upon request of the authorities. In most cases for large multinational businesses, the annual SAF-T file will involve your Certified Accountant (so called ´TOC´) as part of the preparation of the accounting information prepared annually ( so called ´IES´ - Informação Empresarial Simplificada).

Are you filing the correct monthly SAF-T file?

Ever since it was first introduced in 2013, the Portuguese SAF-T file requirements have been updated several times. The current version of the monthly invoicing SAF-T is v.1.04. This version includes the latest changes introduced last 1 July 2017.

In case you are not submitting the latest version to the tax authorities, we can update your SAF-T file automatically using our software.

What are the next steps?

Ideally, you are already reporting your SAF-T files with invoicing data on a monthly basis. If that is the case, we can assist you creating your Annual SAF-T using your monthly data already available.

You will simply need to provide Marosa with information about your accounting plan so we can incorporate it into our software. You will then send us an invoicing monthly SAF-T file and we will create the Annual Accounting SAF-T automatically.

During the set-up process, in case your business does not follow Portuguese GAAP, it is important to have an automated conversion so that the system can generate accounting data. We can also help you automating the conversion into Portuguese GAAP.

Please send us an email if you want to receive more information about how to create your Annual Accounting SAF-T file.

Update 26 March 2018:

The Annual accounting on demand SAF-T in Portugal has been delayed to 2019.