Introduction of German Call-Off Stock Simplification

Following our earlier announcement, the German Ministry of Finance published last 10 October 2017 a decree with additional information on the VAT treatment of call-off stock in Germany.

German call-off stock simplification

The decree states that a simplification for call-of stock may apply in Germany if a purchase contract is in place at the beginning of the transport of the stock and several additional conditions are met. These conditions include that the German customer must be identified prior to the transport of goods into Germany and either the goods must be paid or a binder order must exist between customer and foreign supplier. Moreover, the client must have unlimited access to the goods.

What is the call-of stock simplification about?

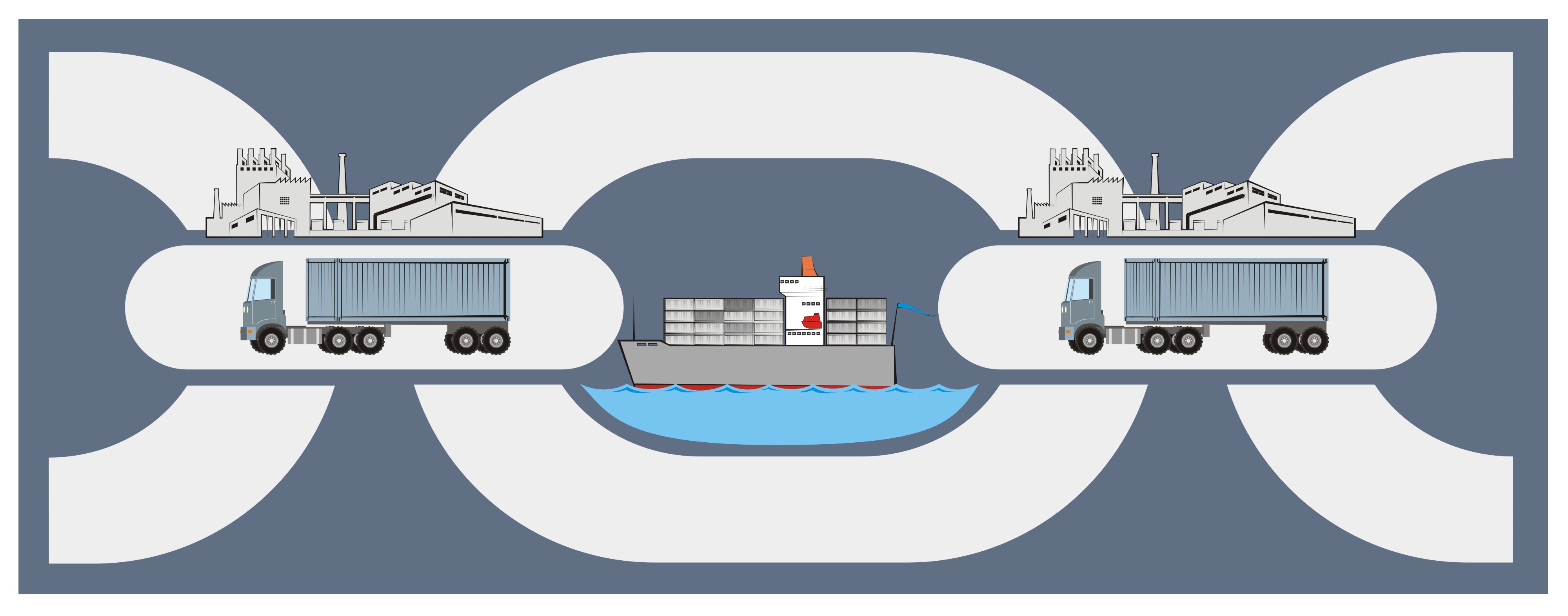

As a general rule, a non-established company bringing stock into Germany and supplying the goods from this stock to a German client must register for VAT purposes in Germany.

In the past, when a foreign supplier sent goods to a German warehouse to store these goods locally and supply them to a German customer as and when required by the client, this foreign supplier had to register for VAT purposes in Germany.

However, where a call-of stock simplification applies, the German VAT registration of the foreign business is not required and the transaction is treated as a “direct” intra-community supply of goods from the foreign business to the German client, allowing a reduction of compliance costs and administrative burdens, as well as cash-flow benefits for the client.

Consignment of stock and call-of stock

When your activity includes these kind of transactions it is important to distinguish between the so-called consignment of stock and call of stock.

The transfer of goods by a taxable person from one EU Member State to Germany to create a stock of goods from which their customer can use the goods as and when he requires them, can be described as a call-off stock. As a general rule, the customer has control of the storage, is aware of stock movements and can take the goods whenever required.

However, when the stock is sent to the supplier’s warehouse and is under its control, the operation is usually classified as consignment of stock. Here the client is no yet known and the goods can be accessed and sold to different customers (more than one). Usually, according to the jurisprudence, this situation still requires the German VAT registration of the foreign supplier.

The difference between the consignment and call of stock is very technical and specific to each country. Also the requirements to avoid the VAT registration differ from one country to another. In Marosa we can help you by making a case-by-case analysis, feel free to send us email if you need further information.