Amazon account suspended. How do I fix it?

This article explains how to activate your account when it has been suspended due to tax reasons.

Table of content

If you are reading this article, you are probably already part of the fascinating Amazon world. In this article, we explain the most common cases of Amazon accounts blocked and their possible solutions.

We focus on your tax obligations associated to your Amazon account. If your Amazon account is blocked for reasons other than your tax obligations, such as the sale of a defective product, various negative ratings by the buyer, or other reasons associated to Amazon policies, then we cannot help you. You should discuss this matter directly with Amazon or with the buyer if applicable.

If, however, your account was blocked because you do not have a VAT number or because you are storing products in an FBA Amazon warehouse, then you should continue reading this article.

Why did Amazon block my account?

The first thing you should ask yourself is: what type of transactions am I carrying out in Amazon and where is the taxable transaction taking place?

There are two possible scenarios:

- You are doing all your sales directly from your country of establishment to the final private individual in another European country. If so, you should track your annual turnover in the country of destination and once you are close to exceeding the threshold of the distance sales applicable in that country, you have to start with the VAT registration process. Amazon is constantly in touch with the European Tax Offices to avoid tax fraud on online sales. Some news have already been published regarding this matter in France, Germany, Italy, etc.

- You have joined some of the Logistics Programs (FBA). You may be storing your products just in one country (i.e. FBA France) or you may have joined some full program as the pan-European program.

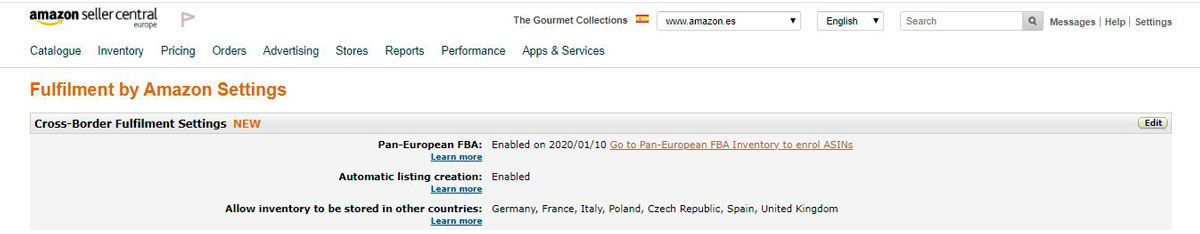

For example, in the previous screenshot we see that the customer is storing goods in Germany, Spain, France, Italy, Poland, the Czech Republic and the United Kingdom. These are precisely the 7 countries that made up the pan-European program previously (As of 2021, the UK will not be in the pan-European program due to Brexit). The Netherlands is also part of the program although it does not require a Dutch VAT number yet.

Very often, sellers do not have foreign VAT numbers because they were not aware of such obligation and these numbers were not requested by Amazon when these FBA programs were launched. These communications requesting the VAT numbers sometimes come months later.

Another of the most likely scenarios is that the tax services are being managed by an internal Amazon supplier, which has registered your business for VAT purposes with a later effective registration date. Recently, we have seen multiple audits, especially by the UK and German tax authorities, in which they requested to regularize the situation prior to the effective date and change that date to the correct one, or the Amazon account would be blocked.

As from when should I register for VAT?

Here is a common mistake when doing a VAT registration when you sell on Amazon: what is the effective date of registration in the country?

We return to the two previous scenarios:

- If you only sell goods to private individuals from your home country (no stock held abroad), a VAT registration must be carried out indicating that you exceeded the threshold and specifying the exact date on which this happened. Given the often delays in processing these applications, we recommend starting the registration at least 4 weeks before the date on which you expect to exceed this threshold.

- If, on the other hand, you have stock stored in one of the Amazon warehouses, your effective date of registration will be that on which for the first a product was introduced in that foreign country for subsequent storage.

How do you know the effective date of registration if I store goods in FBA?

In the menu of your Seller Account, go to Reports – Fulfilment by Amazon – at the bottom left of the page click on Tax – Amazon VAT Transaction Report.

Once you open the report, you should filter by FC_TRANFER on column E ‘TRANSACTION_TYPE’. These are the movements between warehouses that Amazon is carrying out with your stock. In the column BJ ‘DEPARTURE_COUNTRY’ you can check the origin of the shipment and in column BM ‘ARRIVAL_COUNTRY’ the arrival country.

So, if column BJ is just ES and column BM is FR and DE, you know that Amazon is just moving your stock from Spain to Germany and France. Making these intra-Community acquisitions of goods in France and Germany requires you to get a VAT number in the country of arrival of the goods.

Amazon account suspended: how to get it back

Normally, your entire account will not be blocked, only the marketplace in which you do not yet have the VAT number will be deactivated.

If we continue with the previous example and the company is established in Spain, the amazon.es marketplace will continue to be active, but amazon.de and amazon.fr will be blocked for not having a VAT number and all your products will remain blocked in the country until resolving the issue.

The steps to activate your Amazon account are the following:

- Confirm the reason why your account was blocked. Assuming that you require a VAT number, contact a service provider who can help you with the VAT registration and, if applicable, the regularization of your obligations in the country where you are registering for VAT.

- Evaluate getting help from another service provider. You need a quick reaction to your suspended account and all VAT matters should be handled with experience and thorough knowledge of this issue. If you are using the Amazon promotion and you would like to change provider, take into account that tax services must be cancelled before the 26th of each month, and we always recommend downloading all important documents in case you need them in the future for the change of agent. These will be downloaded in: Reports - Manage VAT or File your VAT.

- Once you initiate the VAT registration, you should write a letter to Amazon and explain the situation. This letter should be sent to your contact at Amazon and kept in your records for future reference.

Amazon VAT registration: obligations in Europe for Amazon sellers

At Marosa, our VAT registrations tool will help you to understand the tax obligations you have in each country by answering a couple of questions.

As a rule, if you store goods in a country, you must have a VAT number in that country. For example, if you join the pan-European program, you must have a VAT number in Spain, Italy, France, Germany, Italy, Poland, and the Czech Republic because you hold stock in all these jurisdictions.

Once you obtain the VAT numbers, you are obliged to charge VAT on sales made in those countries and report these sales by filing VAT returns, which may have a monthly or quarterly frequency depending on the country.

In addition, if Amazon is moving your products between warehouses and assuming that you are the owner of those goods in that moment, you must also submit ECSL returns to report such movements.

In some countries it is also mandatory to submit lists of sales and purchases transactions such as the SAF-T declaration in Poland or Control Statement in the Czech Republic.

How do I register for VAT purposes in another country?

The registration process varies in each country, but our VAT registration team will make it a smooth and standard process for all European countries. We will provide you with a single document that indicates the information we need from you for the entire Europe, as well as the corresponding documents. We also specify in which countries it is necessary to translate the documents (simple or sworn) and when notarization or apostilles are required.

Our VAT Registration team will be at your disposal for any questions or clarifications you need in this regard. It normally takes 4-6 weeks for tax authorities to issue a VAT number from the time they receive the original registration documents at their offices. On our website, you can find a summary of how to get a VAT number.