Explanatory notes on OSS

The EU Commission published several clarifications and additional information about the e-commerce VAT package that will be introduced in July 2021.

The European Commission published a 100 page report with explanatory notes on the new OSS regime. The report explains the changes in detail and clarifies the role of Electronic Interfaces like Amazon, eBay, and other marketplaces under the new rules.

Access the explanatory notes via this link

When is a marketplace the deemed supplier?

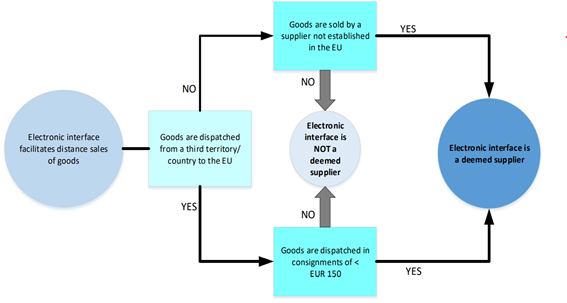

The OSS rules foresee that in certain scenarios, the marketplace facilitating the purchase made by a consumer from a supplier will become an intermediary for VAT purposes. That is, the marketplace will make a deemed purchase from the underlying supplier and a deemed sale to the final consumer. The marketplace will need to account for VAT, and invoicing and record keeping obligations must be met.

The marketplace is only considered the deemed supplier in certain scenarios. Only when the supplier is not established in the EU or the goods are dispatched from outside the EU with a value below € 150, would these deemed supplies take place.

The chart below was published by the European Commission on page 15 of the Explanatory notes on VAT e-commerce rules:

Special arrangements in the new e-commerce package

The explanatory notes provide several scenarios and examples on when the new rules apply. In particular, it explains the right VAT treatment of businesses carrying out a mix of activities such as electronically supplied services and distance sales of goods. It also confirms the scope of invoicing obligations under the OSS and provides several examples and scenarios of different businesses and how the new VAT rules would apply to them.

Get in touch

Contact us now to get more information about the new OSS regime and these explanatory notes